Let’s be honest, the way we grow and eat food is on the cusp of a revolution. It has to be. With a global population sprinting towards 10 billion and climate patterns shifting under our feet, the old ways just won’t cut it. But here’s the exciting part for investors: necessity is the mother of all invention. And in the fields of food and agriculture, invention is sprouting up everywhere.

This isn’t just about buying stock in a tractor company. We’re talking about a fundamental reshaping of the entire food chain—from the seed in the soil to the meal on your plate. The investment opportunities are vast, complex, and honestly, pretty thrilling. Let’s dig in.

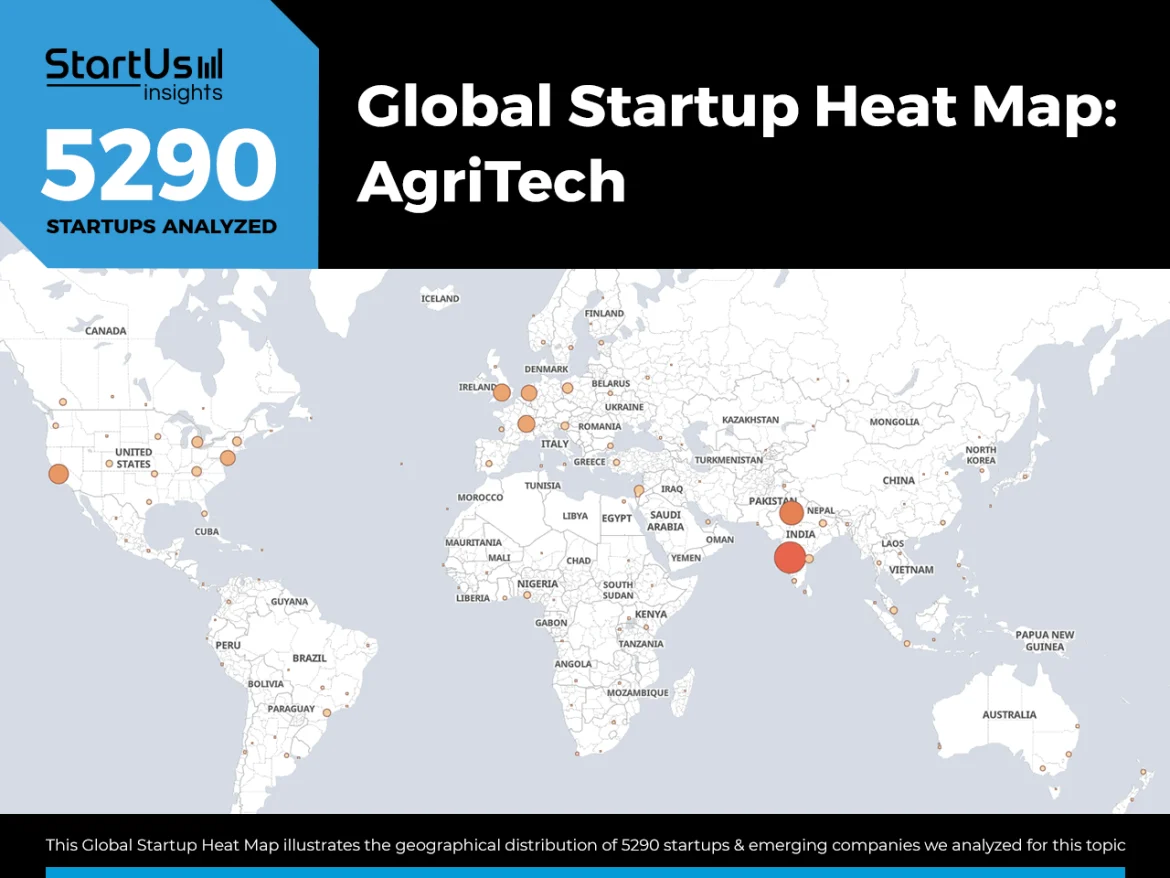

The big picture: Why agri-tech is ripe for growth

You can’t talk about investment without understanding the “why.” The pressure on our global food systems is immense. We need to produce more food with less land, less water, and fewer chemicals. It’s a monumental challenge. But for savvy investors, it’s a beacon pointing towards sectors primed for explosive growth. This is about funding solutions to the world’s most pressing problems—and getting a return on that investment.

Key areas for investment in food and agri-tech

1. Precision and smart farming

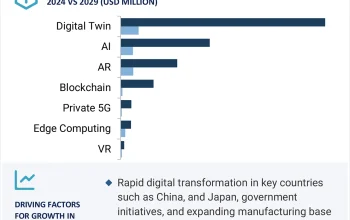

Imagine a farm that runs with the efficiency of a smart factory. That’s the promise of precision agriculture. It’s all about data. We’re talking sensors in the field, drones buzzing overhead, and AI algorithms that tell a farmer exactly when to water, where to fertilize, and how to predict a pest outbreak before it happens.

This isn’t sci-fi. It’s happening now. The potential here is in companies developing:

- IoT (Internet of Things) sensors for real-time soil and crop monitoring.

- Drone and satellite imagery analytics for crop health assessment.

- AI-driven farm management software platforms. These platforms are the brains of the operation, you know, turning all that raw data into actionable insights.

2. The alternative protein revolution

This one gets a lot of headlines, and for good reason. Livestock farming is a major contributor to greenhouse gases. The search for sustainable protein is, well, a gold rush. But look beyond the burger-shaped headlines. The real opportunity is diversifying within this space.

Investment is flowing into three main streams:

- Plant-based 2.0: Moving beyond simple pea protein burgers to more sophisticated, whole-cut alternatives that mimic the texture and taste of meat and seafood.

- Fermentation: Using microorganisms to create proteins and fats. This includes everything from the mycelium used in mushroom-based bacon to precision fermentation, which programs microbes to produce specific proteins—like whey or casein—without the cow.

- Cultivated meat: Growing real animal meat from cells in a bioreactor. It’s capital-intensive and still scaling, but the long-term potential is staggering.

3. Supply chain transparency and traceability

Consumers today want to know where their food came from. Was it grown sustainably? Is the company ethical? This demand for transparency is creating a massive opportunity in supply chain tech.

Blockchain technology, for instance, is being used to create an unbreakable digital ledger for food. Imagine scanning a QR code on a bag of coffee and seeing the exact farm it came from, the date it was harvested, and its carbon footprint. This builds brand trust and, crucially, helps quickly pinpoint the source of contamination in a recall. Investing in companies that make the food journey visible from farm to fork is a bet on a more accountable future.

4. Biologicals and sustainable inputs

We’re moving away from harsh chemical fertilizers and pesticides. The new frontier is biologicals. These are products derived from natural materials like plants, bacteria, and minerals. Think of them as probiotics for the soil.

This includes:

- Bio-pesticides that target specific pests without harming beneficial insects.

- Bio-stimulants that enhance nutrient uptake and improve a plant’s resilience to stress.

- Nitrogen-fixing microbials that reduce the need for synthetic fertilizer.

It’s a sector that sits at the sweet spot between sustainability and productivity. A very compelling place to be.

What to consider before you invest

Okay, so the opportunities are clear. But this isn’t a free lunch. Agri-tech is a complex field with its own unique set of risks. Here’s a quick rundown of things to keep in mind:

| Consideration | Why It Matters |

| Regulatory Hurdles | Especially for novel foods like cultivated meat or new gene-edited crops, government approval can be a long and winding road. |

| Scalability | A brilliant idea in a lab is one thing. Producing it at a cost that competes with traditional agriculture is another beast entirely. |

| Consumer Acceptance | Will people actually eat a burger grown in a vat? Or food tracked by blockchain? Public perception is a real variable. |

| Technology Integration | Farmers are pragmatic. New tech has to be reliable, easy to use, and demonstrate a clear return on investment for them. |

The final harvest

Investing in the future of food isn’t a passive act. It’s a active bet on a more resilient, efficient, and sustainable world. Sure, there will be bumps along the way—some startups will fail, some technologies will prove too clunky. That’s the nature of innovation.

But the direction of travel is unmistakable. The companies that solve these fundamental problems won’t just be profitable; they’ll be essential. They’ll be the ones feeding the world without consuming it. And that, when you think about it, is an investment thesis that truly matters.