Imagine applying for a loan with a blank resume. That’s essentially what it feels like for a “thin-file” consumer facing a traditional credit check. No

Author: Bobby Owen

The Economics and Personal Finance of Digital Nomadism and Geoarbitrage

Let’s be honest. The dream isn’t just about working from a beach. It’s about a fundamental shift in how we think about money, location, and

Building a Legacy: How Strategic Real Estate Syndication Creates Generational Wealth

Let’s be honest. The idea of “generational wealth” can feel like a distant dream, something for old-money families or tech billionaires. For most of us,

Understanding and Investing in the Digital Infrastructure Backbone (Data Centers, Fiber, Towers)

Think of the modern world as a giant, humming organism. The apps, the streaming, the AI, the entire cloud—it all feels… intangible. But it’s not.

Wealth Management Strategies for Digital Nomads and Location-Independent Earners

Let’s be honest. The dream of working from a beach in Bali or a café in Lisbon is incredible—until you start thinking about taxes, retirement,

Leveraging AI-Powered Personal Finance Tools for Credit Monitoring and Improvement

Let’s be honest. For most of us, checking our credit score used to feel like a chore. You’d log into some clunky portal, stare at

Financial Independence Strategies for Single Parents: Building Your Family’s Future, Solo

Let’s be honest. The phrase “financial independence” can feel like a mirage when you’re a single parent. You’re managing one income, a mountain of responsibilities,

Modern Inheritance and Legacy Planning for Digital Assets and Online Businesses

Let’s be honest. When you think about a will or estate plan, you probably picture houses, bank accounts, maybe a family heirloom or two. A

Portfolio Approaches for Adaptive Infrastructure and Climate Resilience

Let’s be honest. The old way of building things—pour the concrete, set the schedule, and hope for the best—isn’t cutting it anymore. Our climate is

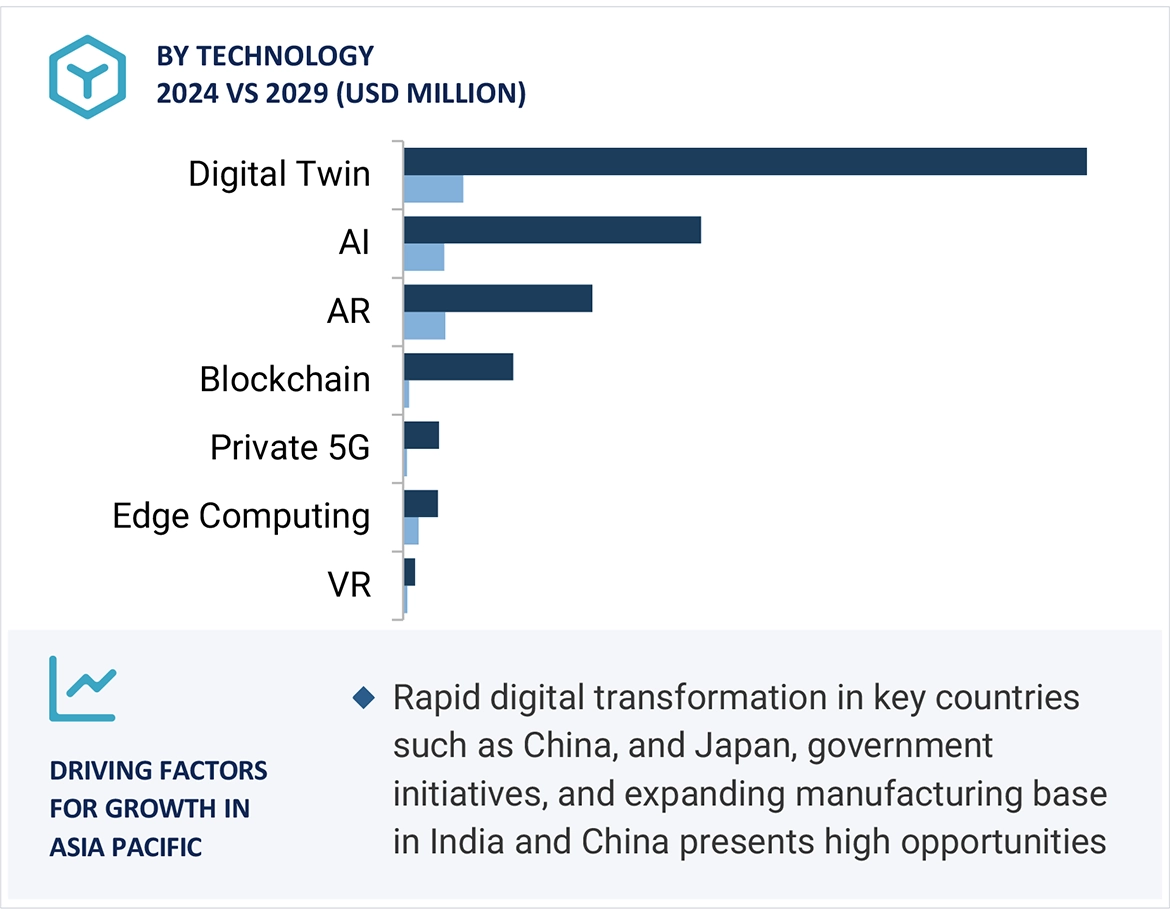

Beyond the Hype: Why Investing in the Industrial Metaverse and Digital Twins is a Game-Changer

Let’s be honest—when you hear “metaverse,” you might still picture clunky VR headsets and virtual real estate. But here’s the deal: the real action, the